How to Use Android Payment Wallet Apps for Safe Online Shopping in India

Introduction

Digital payments have surged in India, especially after the introduction of UPI (Unified Payments Interface). Millions of users now rely on wallet apps such as Google Pay, PhonePe, and Paytm for secure online shopping. As online scams grow, knowing how to use these apps safely is essential.

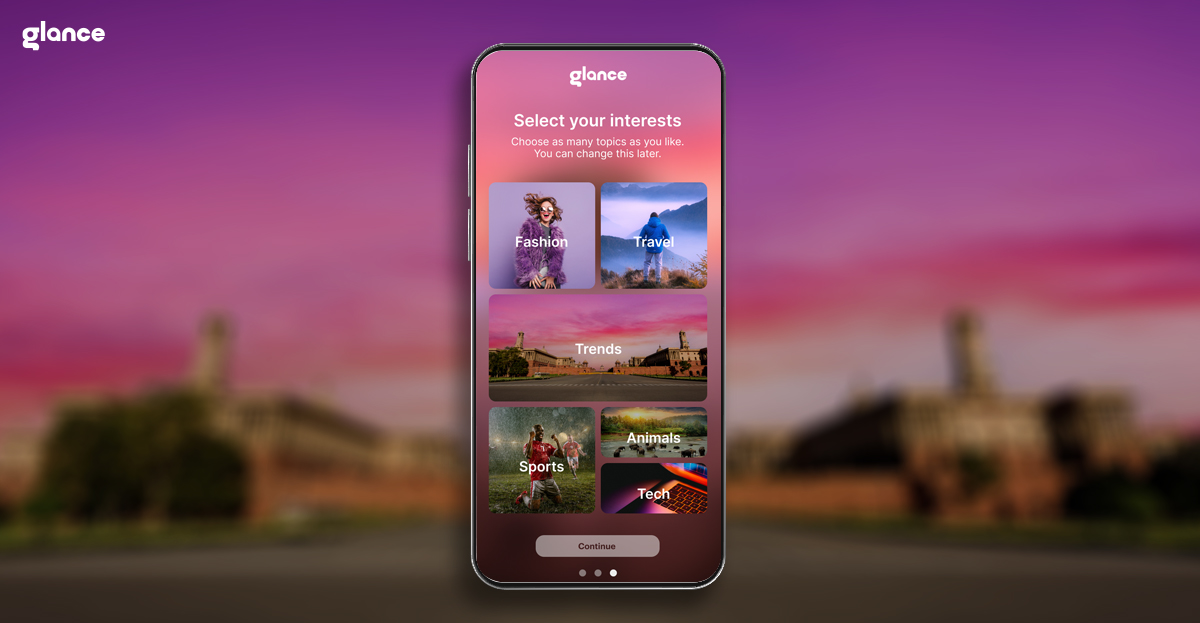

Before we deep dive into safe online shopping methods, we would like to tell you that Glance can help you find out the latest lifestyle needs. Explore the pulse of Lifestyle like never before. Glance brings you trendy fashion updates, breaking news, expert insights, and latest topics directly to the lock screen of your smartphones-no app downloads required. Plus, you can even shop directly from your lock screen with Glance, making it easier than ever to grab the latest must-haves on the go.

What Are Android Wallet Apps?

Android wallet apps are digital tools that facilitate quick and secure payments through smartphones. These include UPI-enabled apps and digital wallets.

Popular Wallet Apps in India:

- Google Pay

- PhonePe

- Paytm

Benefits of Using Digital Wallets

- Seamless UPI Transactions: No need to enter card details for every payment.

- Secure and Instant Payments: Pay quickly without physical cash.

- Rewards and Cashback: Many apps offer incentives for transactions.

Why Use Android Wallets for Safe Online Shopping in India?

Safe and Convenient Payments

Wallet apps reduce the need to manually enter sensitive card details.

Enhanced Security Features

These apps use multi-factor authentication such as UPI PINs and biometric locks.

Wide Compatibility

Wallet apps are accepted by major e-commerce platforms like Amazon, Flipkart, Swiggy, and Myntra.

QR Code Protection

Many wallet apps display transaction histories to prevent fraud from fake QR codes.

Step-by-Step Guide to Using Android Wallet Apps for Online Shopping in India

1. Download and Install a Trusted Wallet App

- Open Google Play Store.

- Search for apps like Google Pay, PhonePe, or Paytm.

- Download and install the app.

2. Set Up Your Account and UPI

- Open the app.

- Register using your mobile number linked to your bank account.

- Verify with an OTP (One-Time Password).

- Create a UPI PIN for secure transactions.

3. Add Your Payment Methods

- Link your bank account via UPI.

- Verify your debit card to confirm your UPI PIN.

4. Enable Security Settings for Extra Safety

- Use biometric authentication (fingerprint or face unlock).

- Set an app lock to prevent unauthorized access.

5. Make a Secure Online Purchase

- Visit trusted websites like Amazon or Myntra.

- Select UPI Payment or Wallet at checkout.

- Authorize the payment by entering your UPI PIN or using biometric verification.

Wallet Setup Examples

Paytm Wallet Setup

Step 1: Download and install Paytm from the Play Store. Step 2: Register with your mobile number and verify via OTP. Step 3: Link your bank account for UPI payments. Step 4: Add money to your wallet for payments. Step 5: Enable biometric locks and PIN codes for security.

PhonePe Setup

Step 1: Download and install PhonePe.

Step 2: Register with your mobile number.

Step 3: Link your bank account and verify with OTP.

Step 4: Enable fingerprint lock and set an app password.

Google Pay Setup

Step 1: Download Google Pay from the Play Store.

Step 2: Register with your mobile number linked to your bank account.

Step 3: Link your bank account via UPI and set a UPI PIN using debit card details.

Step 4: Enable biometric authentication and app lock for secure payments.

Safety Tips for Using Android Wallet Apps in India

- Download Apps from Verified Sources: Use only the Google Play Store.

- Beware of Phishing Scams: Avoid clicking on suspicious links claiming cashback.

- Enable Transaction Alerts: Turn on SMS and in-app notifications for every transaction.

- Avoid Public Wi-Fi: Use mobile data or VPN for secure payments.

- Report Fraud Immediately: Report unauthorized transactions to your bank and visit Cyber Crime India.

Common Issues and Troubleshooting

Payment Fails After UPI PIN Entry

- Check your bank’s UPI service status.

- Ensure your account has sufficient funds.

App Is Not Syncing with Merchant

- Update the app from the Play Store.

- Clear cache or reinstall the app if needed.

Unable to Link Bank Account

- Ensure your mobile number matches the one registered with the bank.

- Use the primary SIM slot for verification.

Conclusion

Android wallet apps simplify online shopping by offering secure, quick, and convenient payment options. By enabling security features and staying alert, you can enjoy a safer online shopping experience.

FAQs

Q1: Can I use multiple wallet apps on the same mobile number?

A: Yes, you can use multiple apps like Google Pay, PhonePe, and Paytm with the same number linked to your bank account.

Q2: What should I do if I forget my UPI PIN?

A: You can reset your UPI PIN through the app by selecting Forgot PIN in the UPI settings and verifying with your debit card.

Q3: Are wallet payments secure in India?

A: Yes, wallet payments are secure due to multi-factor authentication and biometric locks.

Q4: Why does my transaction fail during wallet payments?

A: Possible reasons include bank server issues, incorrect UPI PIN, or insufficient funds.

Q5: What is the daily transaction limit for UPI payments?

A: The daily UPI limit ranges from ₹1 lakh to ₹2 lakhs, depending on your bank.

Q6: Can I link multiple bank accounts to the same wallet app?

A: Yes, most apps allow you to link multiple bank accounts and choose a default for payments.

Q7: How do I report an unauthorized transaction?

A: Open the app’s Transaction History, tap Report, and contact your bank. You can also lodge a complaint on Cyber Crime India.

Q8: How can I earn rewards or cashback?

A: Check the app’s Offers section for active deals.

Q9: Can I use wallet apps without internet?

A: No, wallet apps need internet access for transactions.

Q10: Can I schedule future payments?

A: Yes, apps like Paytm offer scheduled payments for bills and subscriptions.

Q11: What is the difference between UPI and wallet payments?

A: UPI transfers money directly from your bank account, while wallet payments use pre-loaded funds.

Q12: How do I check my transaction history?

A: Open the app and navigate to Transactions or History.

Q13: What should I do if a transaction is marked as "pending"?

A: Wait a few minutes or check the app’s Pending Payments section. If unresolved, report the issue.

Q14: Can I pay utility bills using wallet apps?

A: Yes, you can pay for utilities such as electricity, water, and mobile recharges.

Q15: Which is the safest Android wallet app?

A: Google Pay, PhonePe, and Paytm are safe due to multi-layered authentication.

Q16: Is UPI safer than using credit or debit cards online?

A: Yes, UPI payments reduce the need to enter card details, making them more secure.